Expanding On Our “Less Bearish” Views

Skate to where the puck is going, not where it is today.

Financial markets are in full-on panic mode. After playing a game of chicken with the Fed during 1Q22, the S&P 500 has traded down over 10% since April 1. Trading screens are filled with red as investors dump risk assets, including U.S. and international stocks, Treasury bonds, investment grade and high yield corporate bonds, and cryptocurrencies. It appears investors now understand how serious the Fed is about controlling inflation. It may sound contrarian, but objectively....

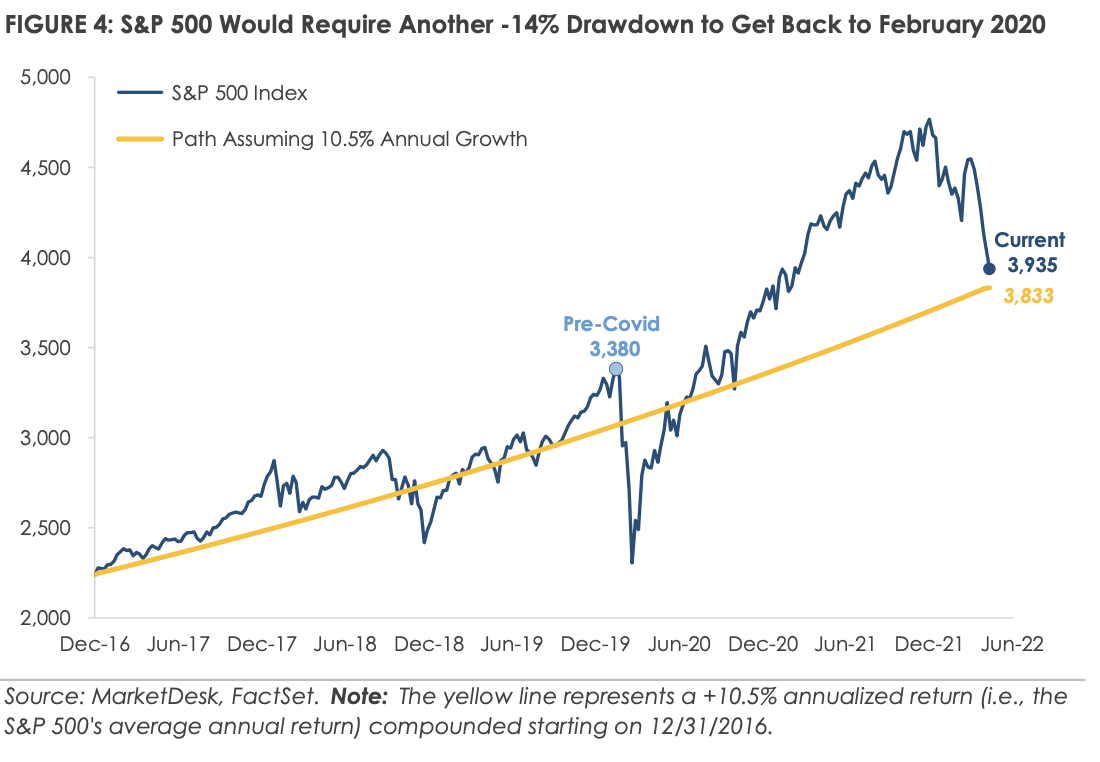

We simply cannot be as bearish today as we were at the start of the year. The S&P 500 is down nearly 20% YTD, and tech stocks are down even more. The easy money being bearish has already been made.

Is everything priced in? It is impossible to know, but 2022's market carnage shows markets already reflect significantly tighter policy. One item to keep in mind – high inflation readings are a 'known known'. The degree of shock from April 2022's +8.3% y/y increase is less than April 2021's +4.2% y/y increase. Persistently high inflation is not a new phenomenon, and the data on inflation expectations indicates investors are already looking ahead. The 5-year breakeven inflation rate, which measures inflation expectations over the next 5 years, is back at levels before Russia invaded Ukraine. Our view is Treasury yields will stabilize, and reverse lower, as inflation expectations peak.